Manage Equity Awards Accurately, Securely & Effortlessly

Guiding Principle: “Equity compensation is a tool for employers to attract & retain talent, an incentive for employees to deliver results, and a means to foster an overall sense of ownership.”

Demo Request

A modern tool for an important offering in employee wellness

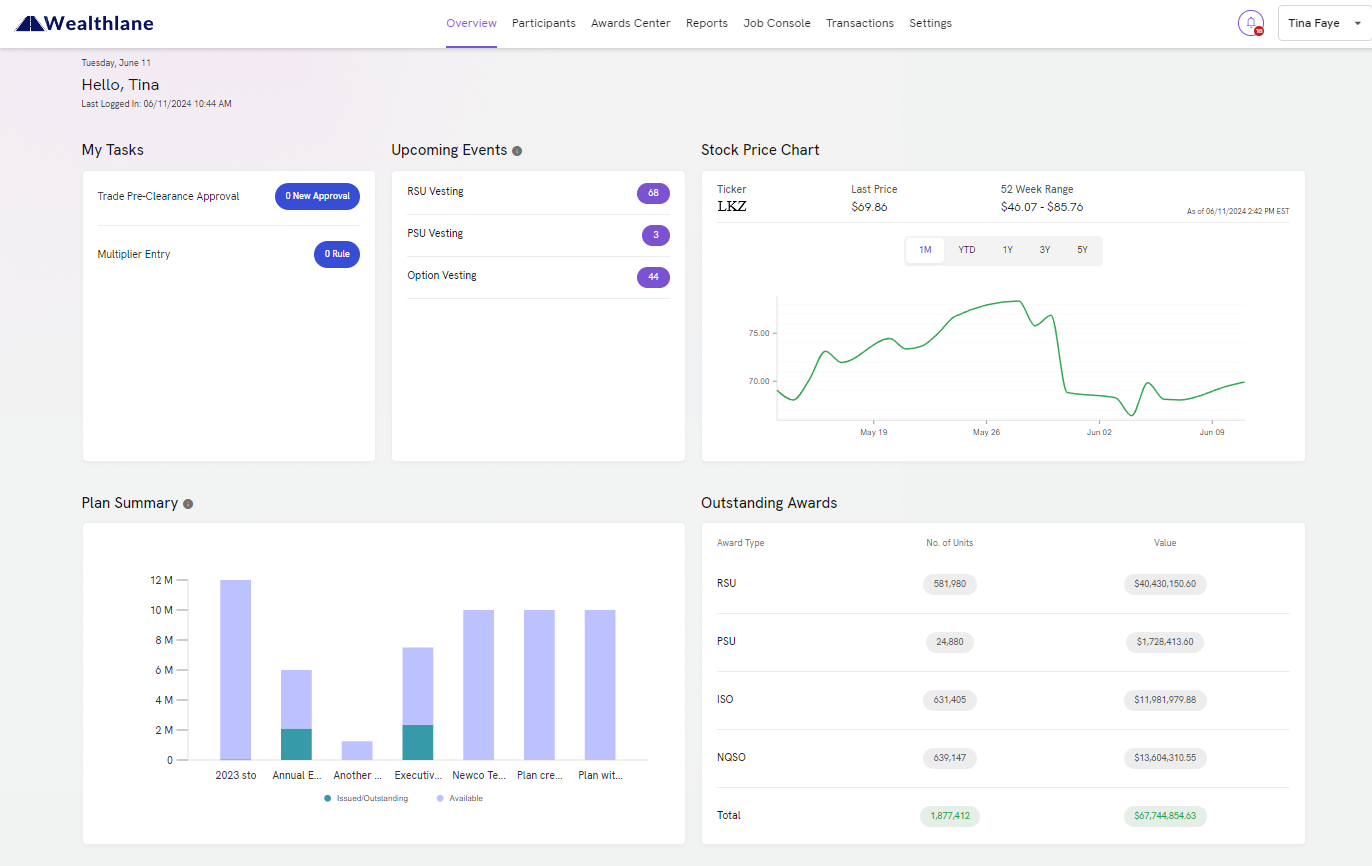

Wealthlane’s state-of-the art platform simplifies equity award management with advanced self-service workflows and automation backed by support from a highly experienced team.

Why Wealthlane?

Newly Developed Technology

A cloud-native and cloud- agnostic Platform-as-a-Service (PAAS) solution with real-time data and ZERO latency/batch- processing.

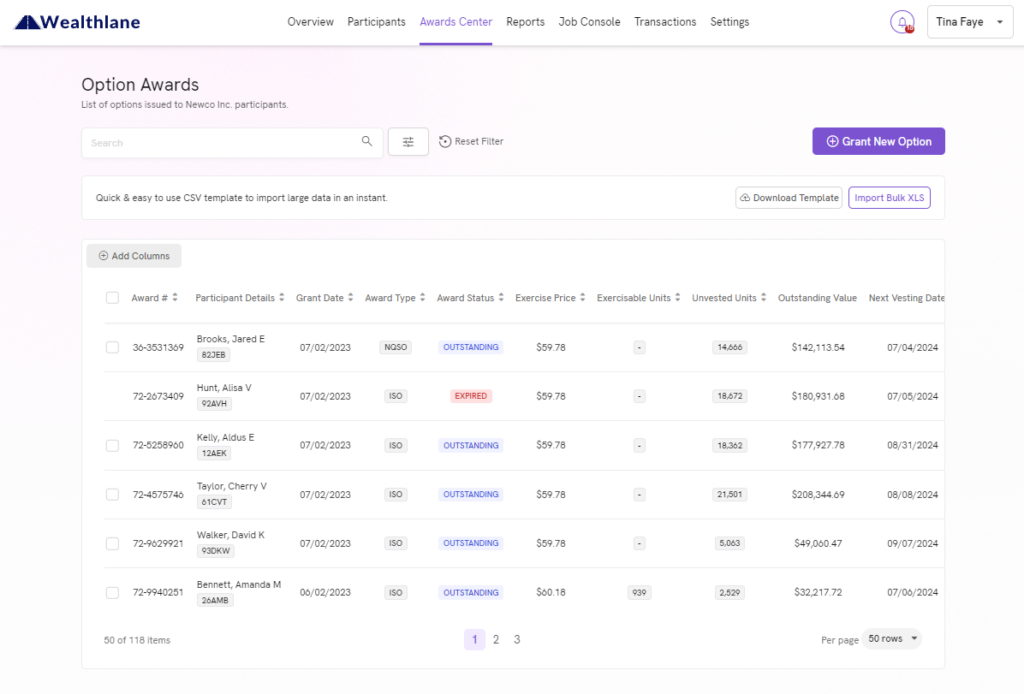

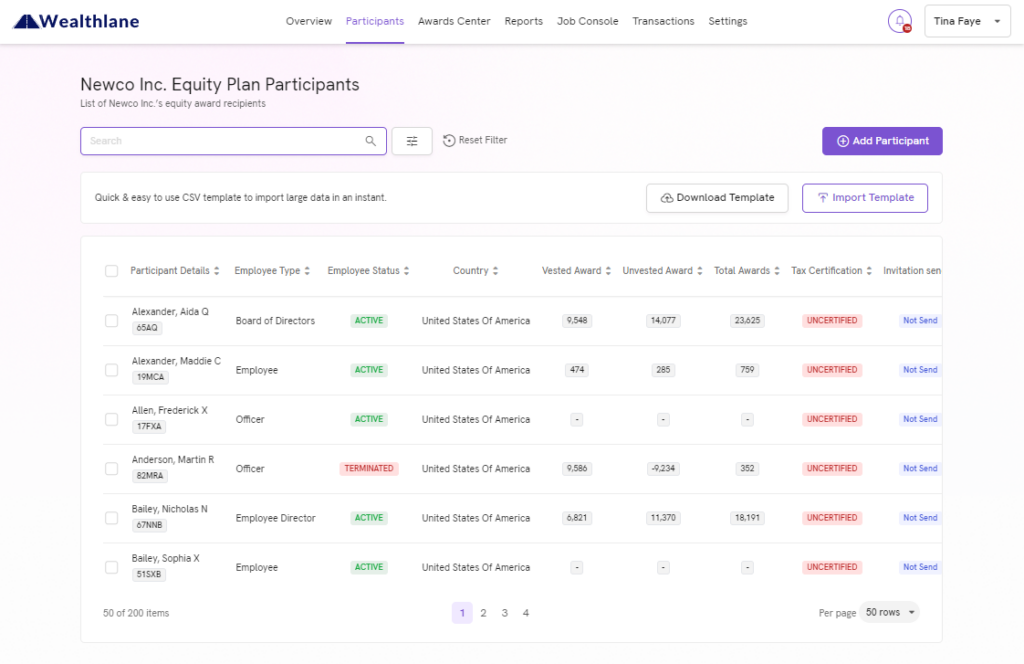

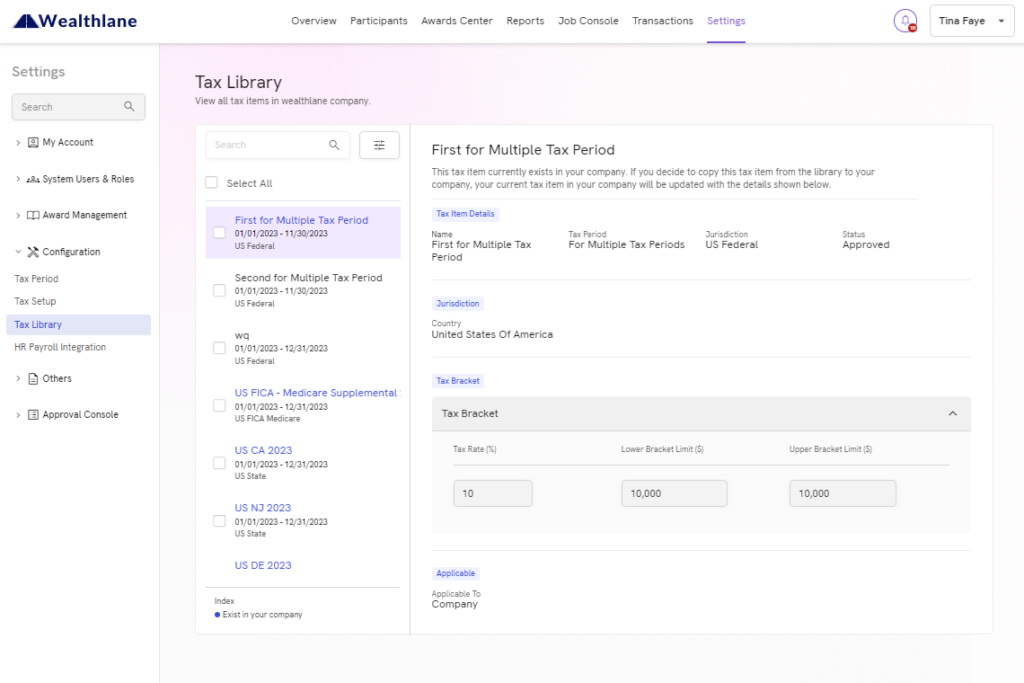

Comprehensive Functionality

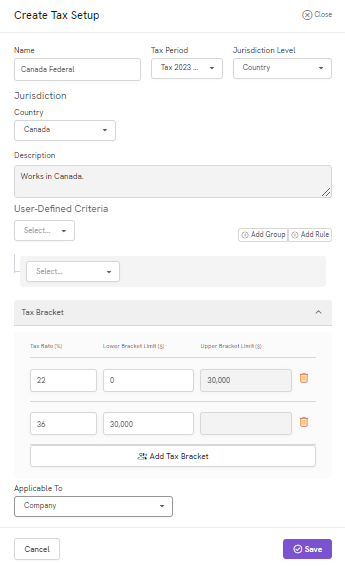

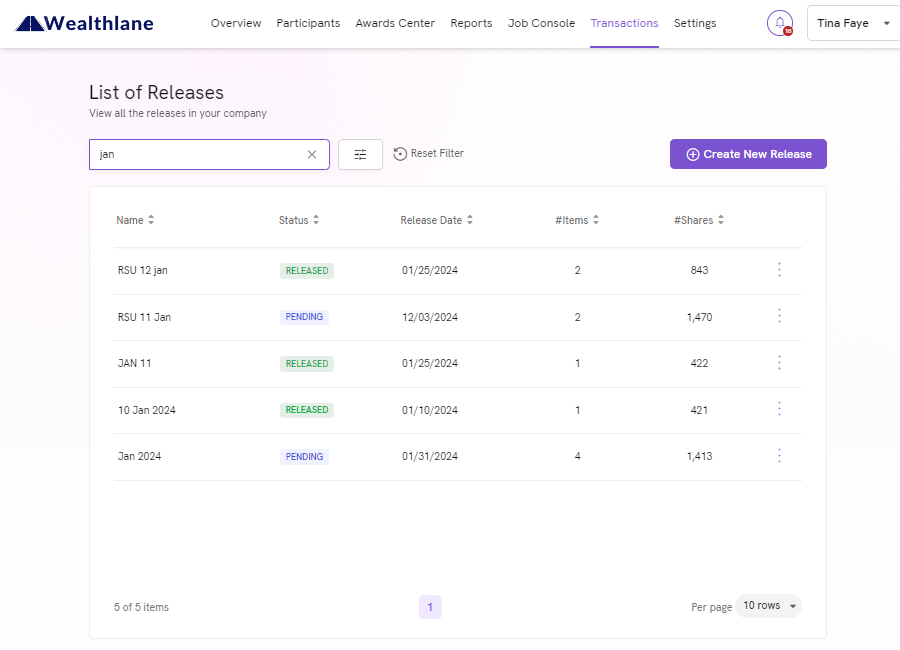

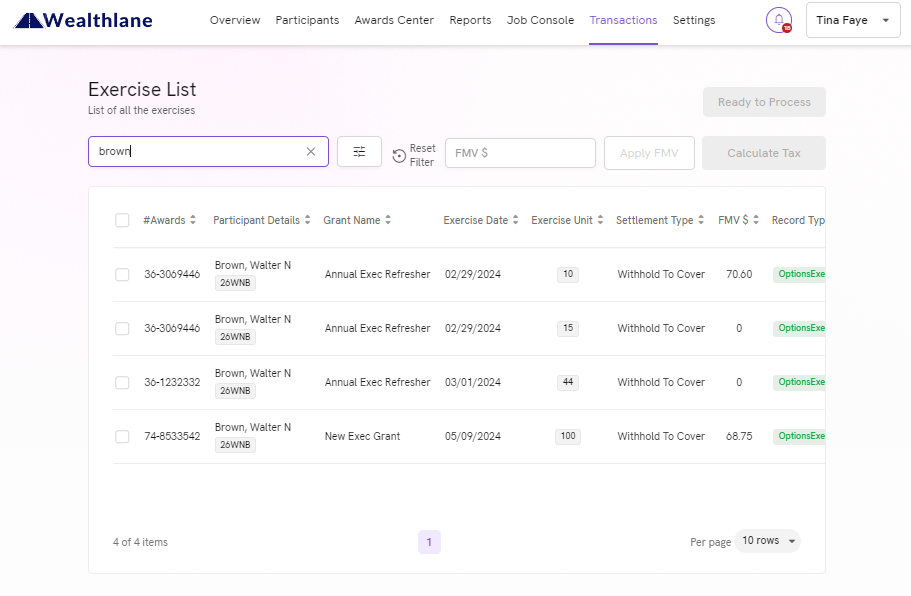

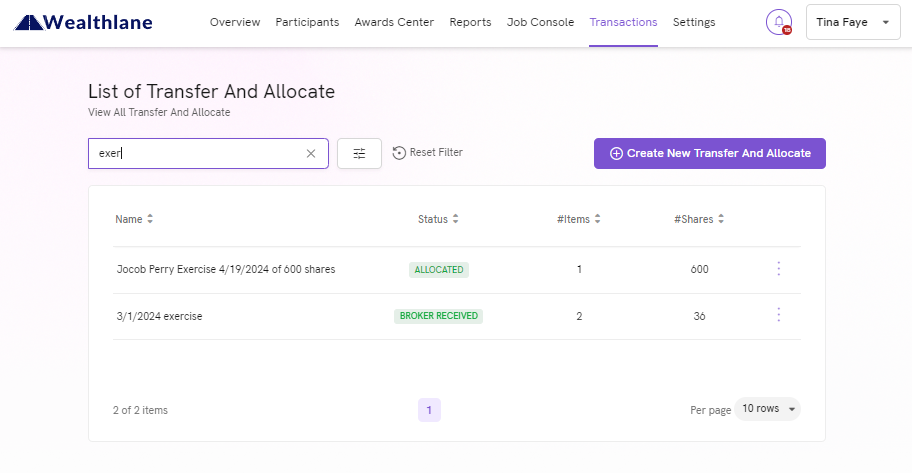

Diverse equity award types with the freedom to work with brokers of your choice. Configure global taxes or leverage our U.S. tax libraries. Review and make real-time tax adjustments on transactions.

Serving Underserved Smaller Companies

No minimum stock price or award

amounts, serving all industries

including bitcoin, crypto and

cannabis.

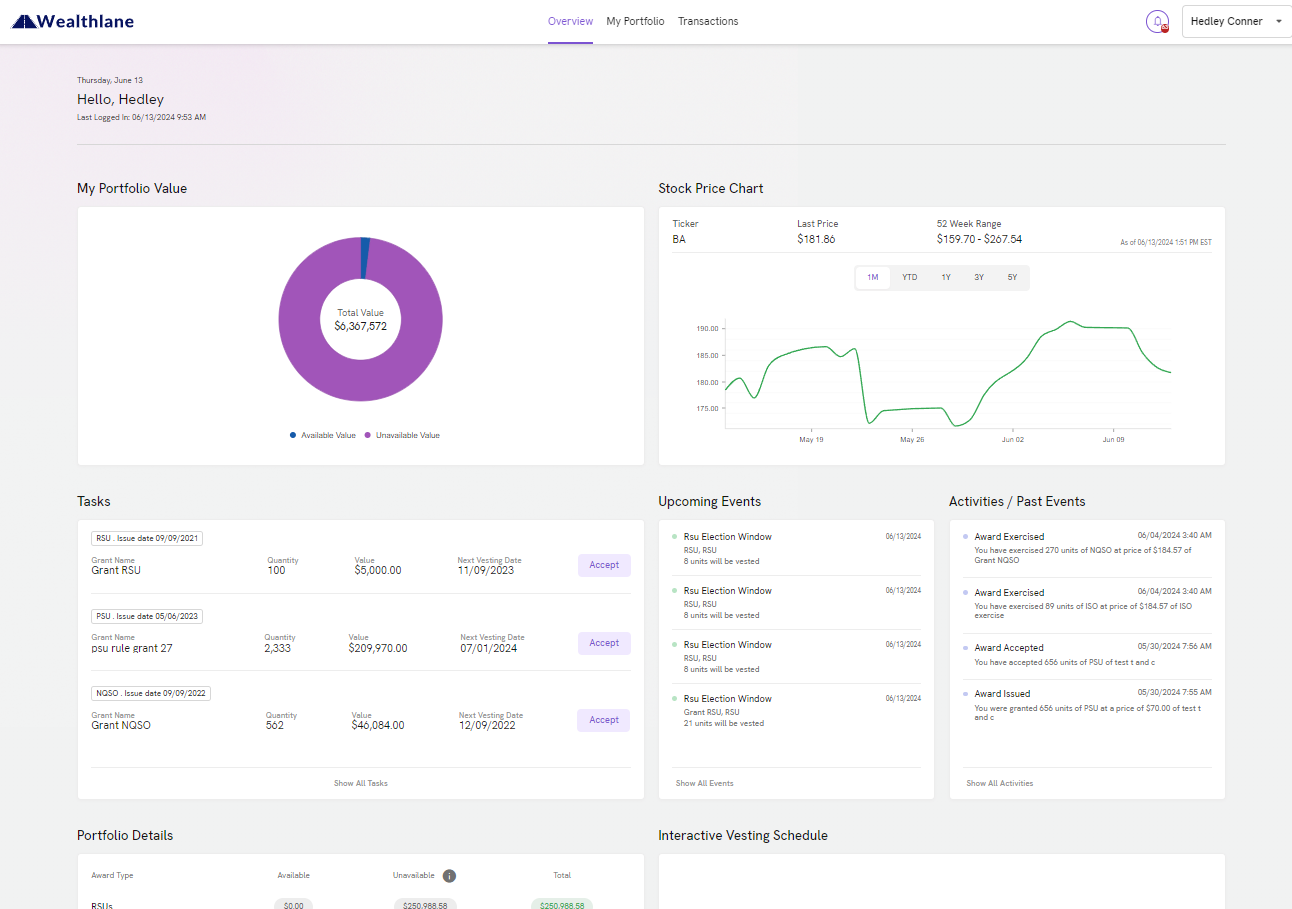

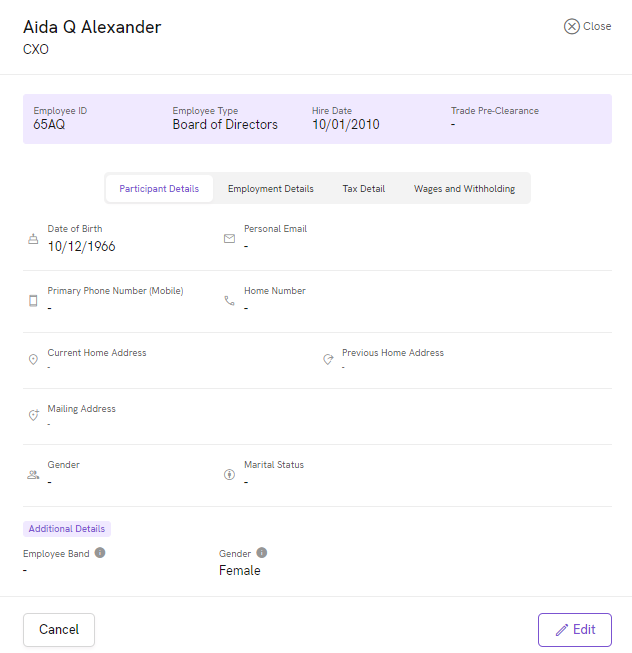

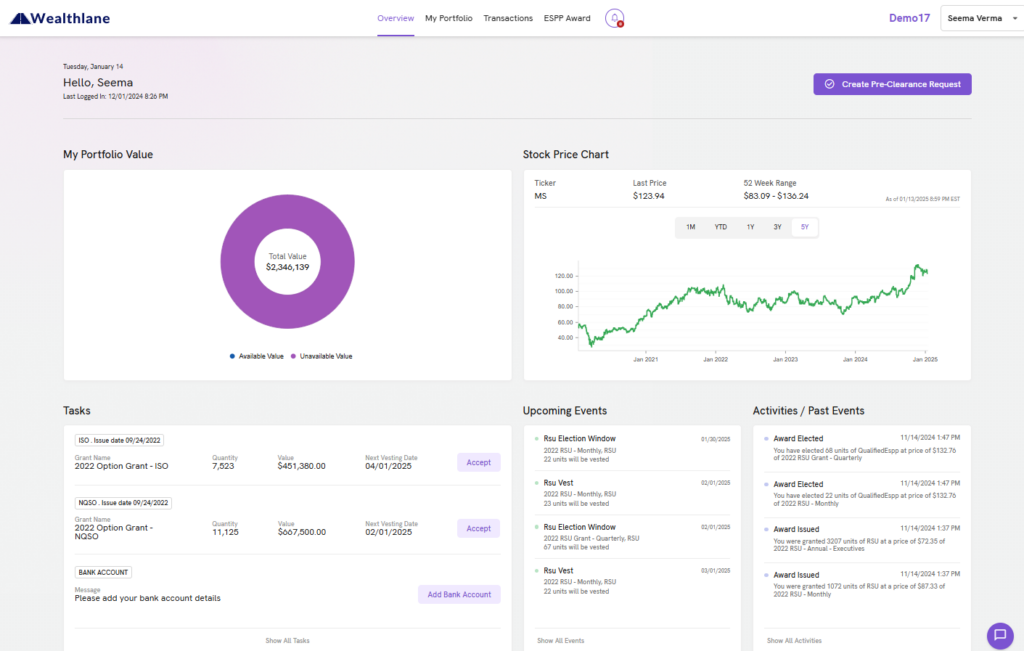

Simple, Intuitive User Interface

A flexible, scalable platform that is easy to navigate and cost-effective.

Sandbox Functionality

Create unlimited “what if” scenarios without modifying real data or losing your work.

Built-in AI Tools

Configure our AI assistant to answer any general, platform or company-specific questions for your participants and administrators.

Secure and Granular Controls

Maintain ironclad security with complete

control over user permissions while

fostering seamless collaboration with all

stakeholders- service providers, finance,

auditors, legal counsel, tax advisors, etc.

Plug-and-Play, White-Label Platform

Our platform can be customized and

licensed to any firms who wish to leverage

Wealthlane’s technology to offer stock

plan solutions.

Features

For Employees

Team

Co-Founder

Kedar Koirala

20+ years in Wealth Management & Stock Plan, Merrill Lynch, Morgan Stanley, E*TRADE, Carta

Co-Founder

John Wang

20+ years at E*TRADE, Former CTO of E*TRADE’s stock plan services (EEO)

Advisor

Scott Schwartz

15+ years in equity advisory services including Financial Reporting, Complex Transactions, System Implementation, and Employee Education for private and public companies

Board Member

Tarek Hammoud

Founder and Former CEO of Enfusion, a pioneer of front-to-back SaaS solution for the global hedge fund industry

FAQ

Frequently Asked Questions

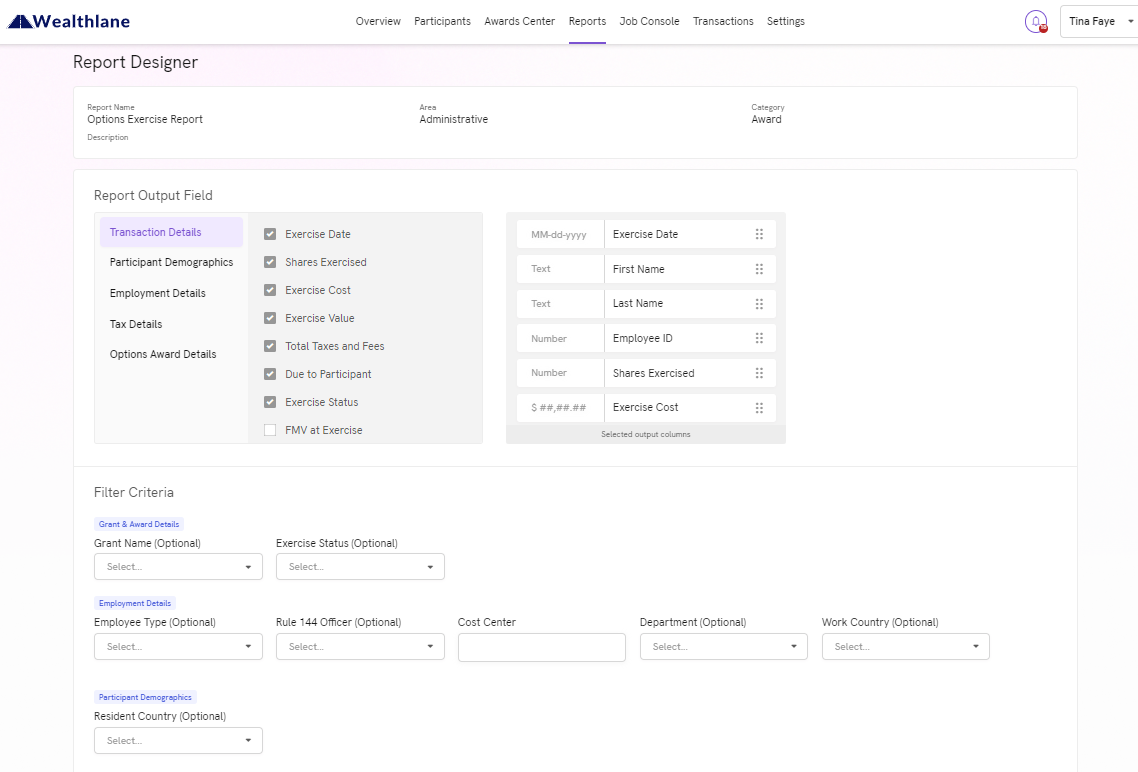

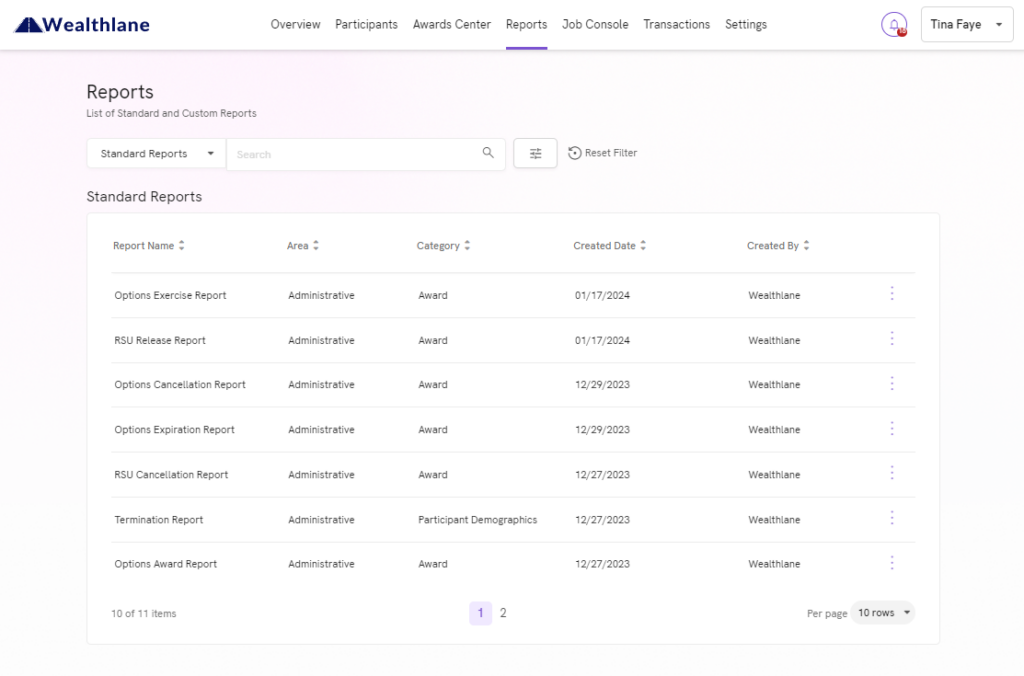

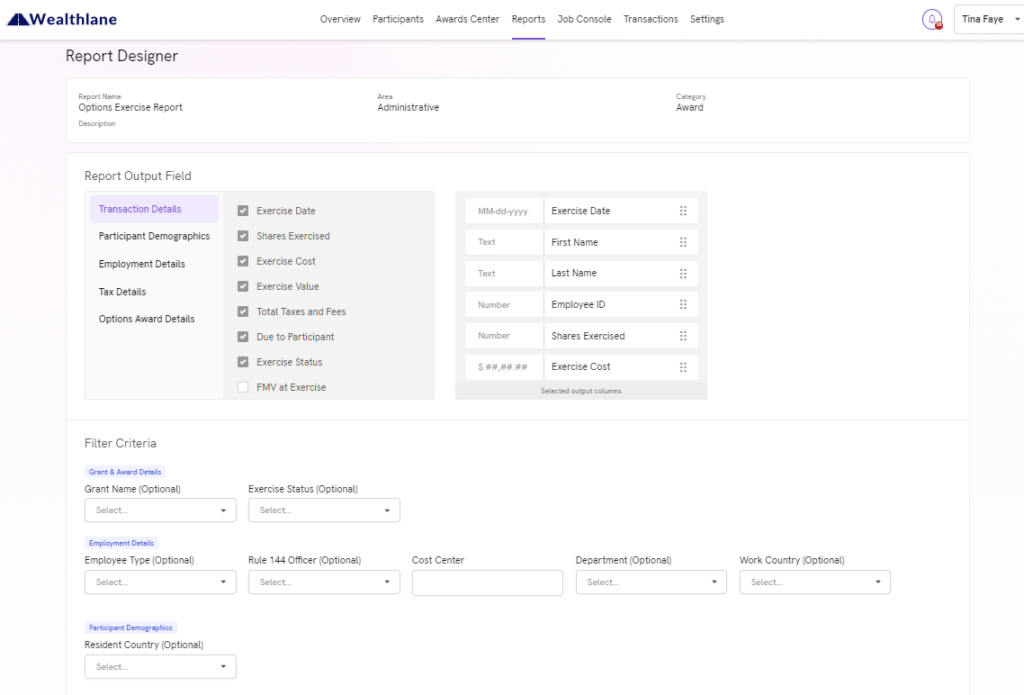

What reporting and analytics features does the platform offer for tracking and analyzing equity grant data?

The platform has a dynamic reporting feature that allows for highly customized reporting and analytics.

What reporting and analytics features does the platform offer for tracking and analyzing equity grant data?

The platform has a dynamic reporting feature that allows for highly customized reporting and analytics.

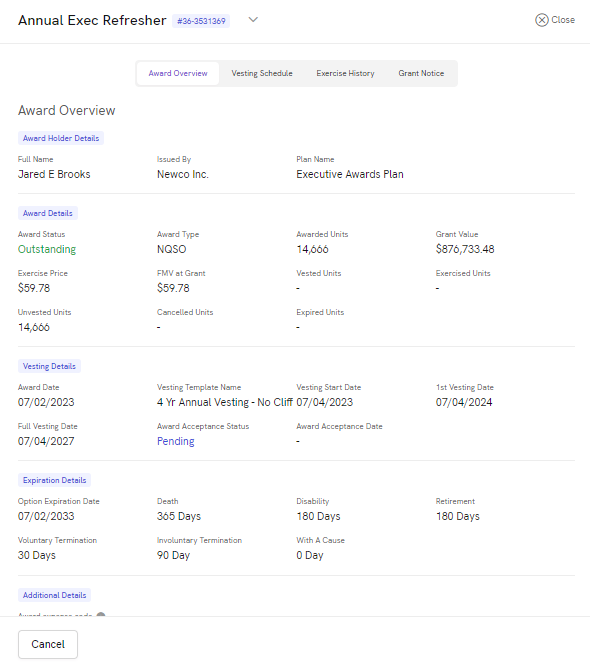

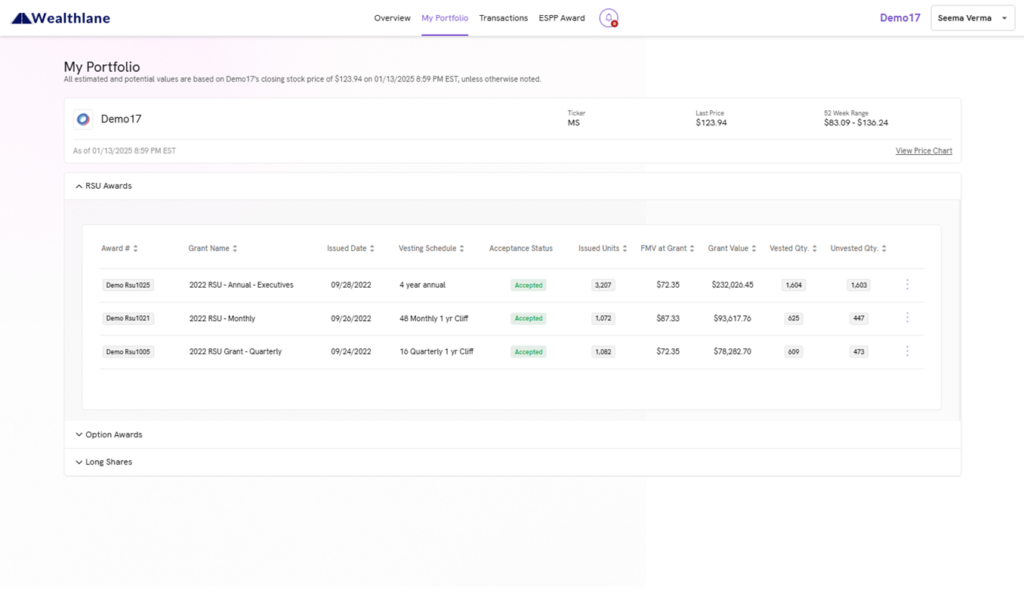

How does the platform handle the vesting and exercise process for equity awards?

The platform provides built in workflows for processing vesting and exercise events.

Can the platform automate equity plan administration tasks, such as grant approvals, participant transactions, and compliance tracking?

The platform has built in approval, pre-clearance, and blackout workflows. Participants can initiate transactions for selling long shares and exercising options on the platform.

Can the platform accommodate plan designs and rules specific to our company's equity program?

The platform is highly configurable and is able to accomodate options, restricted stock units, performance stock units and employee stock purchase plans.